24 Şubat 2012 Cuma

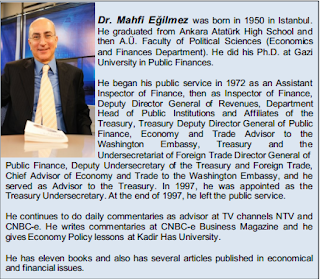

Mahfi Eğilmez Hocamla..

Q: We are face to face against a very heavy agenda. The low growth rates in the US, the decrease in the Chinese PMI, the low demand below expected levels towards German bonds and also, perhaps the most critical thing for us is the change in our country’s rating outlook from “positive” to “stable” by Fitch. Under these conditions, if we look from macro outlook to micro outlook, what does this present scene tell us?

The week that we have just completed is a typical summary of the conjecture that we are in. There is a serious uncertainty and this is becoming more prominent every day. Up to 30 to 40 years ago, we used to look at the mechanical side of things, but since economy is directly related to human psychology, we see that perception of people, their expectations, and their psychology plays an important role in the economy. When

people believe that the economic outlook will become worse, they stop their spending, they change their investments to different areas, they turn towards the US Dollar, which they used to run away from and a terrible shake up happens. This week, similar things happened. In addition, the disagreement of the Super Committee in the US on budget cuts and the fact that they were not able to come to an agreement on debt ceiling, shows us that forget about whether the economy is recovering or not, even the most primary decisions concerning the economy cannot be made. This is a situation seen in many countries. It damages the expectations and worsens the perception. On the other hand, Europe looks very helpless. They are facing a huge debt accumulation. Their growth is decreasing and the climate looks like they will be entering a recession. This climate is spreading to the whole world. It was stated that China, India, and countries like us were separated from this crisis and that they would be less affected from these developments, but it isn’t happening that way. It is not an easy feat for China to haul the whole load of this crisis. China is a very huge economy, but it is affected even with the smallest disturbance, since it needs to sell its products that it manufactures to the Europe and the US. The global system affects everyone just like joint cups. Since the beginning of the crisis, Turkey has been able to handle its situation well so far. There was a year of recession that took place, but under these conditions, it can be considered as normal. In the upcoming period, this doesn’t seem possible to continue under the same conditions. Because, it is not something that depends on Turkey. Europe is our actual export center. When we look at the debt figures, it is not possible to disassociate ourselves from the crisis too long. I don’t think that even China, with its huge economy, won’t be able to easily disassociate itself from the crisis. Hence, if the expectations are not fixed, and if negative expectations are not refracted; such as in the case of Greece not being able to take a loan again, if Italy cannot gather herself and if all other countries won’t be able to exhibit positive signs, then this situation will head to serious levels. The reduction that Fitch has made in our rating outlook is principally due to the current account deficit and due to inflationary apprehensions. People who look from the outside are awaiting an orthodox attitude from the Central Bank, which is an increase in the interest rates. The Central Bank is not showing that attitude and it prefers to use other tools instead of adjusting the interest

rates. Fitch must be thinking that the Central Bank is trying to balance the current account deficit with the developments in the exchange rates and they must feel that this is not going to be effective in the short run, so they have reduced our rating outlook. It is evident that they have focused on the policies of the Central Bank. If a decision on an increase in interest rates had been taken in the Monetary Policy Committee (MPC) Meeting, then probably, there would not have been a change in our rating outlook.

Q: Is Fitch or the Central Bank showing the correct approach in this regard?

For the current account deficit, it is important to wait for the last quarter. I was expecting a downward trend in September, but it didn’t happen. In fact, just the opposite, it became to the highest level, as compared to all the previous periods. When you look at it this way, you start thinking whether there is something missing

in the policies of the Central Bank. We know that there are surprises in the way that Turkey approaches things, but from the point of view of the West, such as Fitch, the same approach of looking at things may not be same. I think that the Central Bank should have played a little with the interest rate.

Q: The current account deficit is continuing to increase. Then will the slowing down of the growth, which has been predicted for the 3rd and 4th quarter, not take place?

I think that we will surpass the growth rate of 7.5% in the Medium -Term Plan. I don’t see any slowing down. There is no decrease in the domestic demand. If Fitch also sees this and if there is no decrease in demand even with the increased exchange rates, then they may think that there is no other way to handle this except to increase the interest rates. I also feel that they may be right. The Central Bank has to stay away from an image of not utilizing its most important weapon, which is the interest rates and it should especially use it in these critical times.

Q: The growth, which will surpass 7.5%, and the 4% growth suggested in the Medium-Term Plan (MTP) for 2012 is going to cause us to have a landing that cannot be called “soft landing”.

The number given in the MTP is 4%. The IMF’s estimate is 2.2%. Hence, if we say 3% on average, then this means that there will be a huge decrease after the 8-9% growth in 2011.

Q: Where should the Central Bank position itself at this point?

The Central Bank’s job is neither very easy. In one side, there is the interest rates instrument, and on the other side when you lower the growth rate too much, there is the problem of getting into stagnation, as in the Europe. As a matter of fact, this is what we call macro economy. Among various contradictions, it is the concept of reaching the intended function by getting a couple of instruments together. In the last MPC Meeting, the interest rates could have been increased somewhat. Even without increasing it, if it had at least given this signal, then Fitch may not have changed the rating outlook.

Q: In his recent speech in London, Ali Babacan shed some light to the economists on the interest rate increase.

Ali Babacan, he is showing an optimistic but also a very cautious approach. If you are managing the economy, then taking an attitude that brings the risks as well as the earnings together is the correct thing to do. He is giving a secret message to spending Ministries by trying to say don’t open up too much and he is also saying that it is not right to grow so fast in this environment. When we look at the January-September period, we see that approximately US$ 60 bn of current account deficit has taken place. The US$ 10-11 bn part of this was directly handled through foreign direct investments. If we put aside the net errors and omissions, then the remaining US$ 40 bn is handled through hot money. I believe that this method is a very low quality way of financing arising from a short sighted approach. This deficit needs to be controlled by decreasing the growth. When I look at all these, I don’t think that Fitch was wrong in their rating outlook reduction. In essence, not bringing Turkey’s note to “BBB” in 2007 was a mistake. When we look at Turkey’s 2007 outlook; when we take the budget deficits and current deficits into account and also by taking the neutralization of the effects of the 2001 crisis into consideration, the credit rating should have become “BBB”. Turkey should have become “BBB” since 2007, while all other economies should have had their credit rating reduced by 1 or 2 levels when the crisis had started. It was wrong to keep the US at

“AAA” during that period. It shows that Fitch did not show a flexible approach when they didn’t do an evaluation during the beginning of the crisis and lowered the rating after the crisis started. I think it was very wrong for them to consecutively lower the credit ratings in Greece, waiting the crisis to start.

Q: What do you think about the idea of focusing on growth instead of always being on guard while financing the current account deficit, and on discarding growth in case of financial troubles?

It is not being widely used now, but many politicians were saying that as long as the current account deficit is financed, then it is not a problem. This became very widespread belief between economists for some time. “As long as finances are found, it is not a problem” or as long as it is financed, it isn’t a problem. But what happens when we can’t finance it? The important thing is how big the current account deficit is, and rather more importantly, it is about how it is financed. Let’s say that Turkey has a current account deficit of 6%, but if this current account deficit is being financed around 80% to 90% with foreign direct investment, then this is not a problem. This is because we don’t have the responsibility of paying back this money. This money will come, it will construct a factory here, then that factory will make some money here, that production facility

will make money, and a portion of that money will be taken abroad as profit. As long as it is earning money, there is no problem. This is because it can sell abroad, exports can take place and Turkey can also benefit from those incomes. But, the real thing that matters is the hot money. A portion of it is portfolio investment; which means either it comes as stock trading, as Treasury bonds or some of it will be directly in the form of

a loan. Either it will come as a deposit or it will come as a credit loan to companies. It is not easy to revolve these. This means that those companies either have to earn money or they have to be exporting in order to pay back that money, so that they can get a loan again. I am speaking to many industrialists. They say that in the past when manufactured goods was produced for U$ 100, the US$ 40 was from imported goods, such as intermediary goods, or raw materials; while now they say that this has become US$ 80. When it happens like this, when it becomes impossible to finance, then it means that all the production will die out. This possibility gives us headache.

Q: You are defending temporary import substitution at this point.

Yes, I am defending this. This has also been misunderstood. I am not an import subsidy person. If you are bringing this tea glass for US$ 1 from abroad, you can’t continue to protect the local manufacturer who is making it for US$ 2. But, you can do this for 3 years. First, the person will start with 2, then it will decrease to 1.50 and then 1.20. The third year, it will come to such a position that it will come down to 90 cents. This is what I meant. Temporarily and partially, import subsidy has to be done in selected areas. The Government, as well as Zafer Caglayan, has also embraced this idea. They have even made preparations for it. In some areas, they have even imposed taxes and they have applied stabilizing taxing. But, widespread usage has not been implemented yet.

Q: Anyhow, before 80’s, this was the application...

Exactly, import substitution is absolutely not a good model. I remember what one industrialist once said: In the past, we would do an import worth of US$ 40, use US$ 60 in national production, now when we say that our import has become US$ 80, then what happened to our US$ 60 production, why did it lose 20% share. So, what did we lose there? If we had supported that person for another 2-3 years, could we have manufactured that piece cheaper, as compared to the one coming from India or China? We have to look at all of these details. Is the energy more expensive, is the labor more expensive or are the taxes too high? We

have to look at these and do an arrangement to revitalize these. In other words, we need to work on this. Otherwise, we will have large current account deficit all the time. We will keep having it and more growth will create more current account deficit. Hence, current account deficit is the problem and a big current account deficit along with bad finances is a problem, we have to look and search to see how we can solve it.

Q: In 2012, there is a targeted account deficit of 8% in the Medium-Term Plan. 8% is very high and in 2012, the liquidity, money flow, and capital input will be tougher as compared to today. The question is to how to handle this deficit. In 2012, there will be a serious liquidity problem in the global system. Although US$ 10 bn of the US$ 60 bn current account deficit is financed by the foreign direct investment, the next year this number may even not be that high.

Q: In an environment, where the global capital is this timid, this will be very difficult.

It is a difficult situation. Thus, even though we get angry at them, these are the things that led Fitch in its latest decision.

Q: There seems to be a paradigm problem that is dominant in the world economy. Now, we see that everything is constructed on volatility, exchange rate wars, and on expectations. For example, exchange rate wars such as Japan Central Bank’s printing of 5 trillion yens and putting it out on the market. Without taking the primary production factors into account, without optimizing and improving them, how we are going to get better? Won’t low growth rates and expectations of recession bring a loosening up of monetary policies? Is there a way out, besides printing money?

I mean there are one or two concepts in my mind, but what you are saying is absolutely correct. When you look at the history of economics, we see that from time to time, paradigms are forced to change. The system, rules, and the understanding, which is dominant today, is always towards accumulation. But when the

accumulation suddenly shows changes, then that paradigm becomes insufficient. The understanding of the concept, its description, and its solution along with our accumulation of economic policies belongs to the era before the globalization. We are used to think that way, which means it was an enclosed capitalist system, because back then there was a socialist system against capitalism. In other words, the world was not in such a global system. First of all, capital movements were not that free. I mean, an American coming to buy a bond from Turkey or a Japanese housewife investing her money here, or a Turkish person is going to America in order to invest money for copper fund; these things could not have been dreamed of. Now, the system has changed completely, but we still perceive this with the old mentality and are trying to get solutions with old policies. Accordingly, we need to create new points of view. And this is what happens with every

crisis. For example, you can look at the crisis, which happened right after the industrial revolution. For instance, the 1930 crisis which came due to the financialization of capitalism... Thus, the system has changed, the situation has changed, the life has changed, but the truth of the matter is that the theories, which explain these things have not adapted. It takes some time, and I think that we are now within this period. Consequently, we try to solve things with the old mentality. For example, remember how the crisis of 1930 was solved? Here is the hole, dig it, fill it etc. Keynesian model, spend money, let people have money etc.... It doesn’t happen this way anymore. America has tried this. It printed trillions of US Dollars and it distributed them under TARP models etc. The Americans who took this money didn’t spend it and they went to invest in funds, and those funds then sent the money to Turkey or to wherever there were high interest rates. It wasn’t like this before. When you distributed the money in America, the Americans were spending it. The butcher was earning, the grocer was earning and the situation was revolving. I mean

that this has changed, so what you are saying is absolutely correct. All the countries have to come together and they have to find a solution. The G20 was founded for this purpose, but it is not happening, in fact don’t forget that even America is not able to find a solution within itself…

Q: Similar to a formation like Bretton Woods...

There is a need for a new Bretton Woods. In addition, we also have to change our economic understanding. For example, the things that we study or teach today as economy is fine, but expectations have entered the situation. There are many reforms, but mostly the economy lessons of pre-globalization are being taught. Even the economists think that way. Globalization is something that is totally different. Now, I have to create a solution appropriate to this and I have to develop it. The IMF’s situation is the same. It has created recently something called precautionary liquidity line. The IMF is always developing the same things. It

never has contributed to the solution. I had written these back in 1998. Back then, I was writing in Yeni Yüzyıl and I found that article. I had made a suggestion to the IMF. Back then, Stanley Fischer was the second person in the IMF. I wrote my suggestions and I sent it to him. There was a 97-98 Far East crisis at the time and immediately thereafter there was the Russian crisis. These crises affected the indebtedness capacity of other nations. For example, it also affected Turkey. Even though it wasn’t directly affected by the crisis at the time, the loaning capacity of Turkey became more expensive, the loan periods became shorter and the same thing happened to Poland, as well as to Hungary... Everyone got affected one way or another. My suggestion to the IMF was to create a guaranteed loan opportunity, i.e. give a guarantee instead of money. For example, say to Turkey that even though that you were not at fault, you got affected due to this crisis. Let’s look at your precautionary measures together and let us become a guarantor to your international loans that you are getting. For instance, if you are going to get a loan for US$ 1 bn, let the IMF become a guarantor to the 30% of this loan. What were the advantages? When the IMF enters the equation, the due dates would be longer and the interest rates would decrease. As long as the country doesn’t go bankrupt, the IMF doesn’t have to give any money, the IMF only gives a guarantee. Today, this is what needed. In fact, today I said the same thing in my broadcast and I am going to send it to Mr. Babacan as a letter. I had suggested this and this is the perfect time to it, and to bring it to attention in G20. This is the essence. At the time, Fischer answered me. He said that it is an interesting suggestion and they were working on it with the World Bank. I think it was an answer out of courtesy. But, it is not something that is suitable to

the mentality of the IMF.

Q: What awaits us in 2012? Around which points do they have to be careful?

I always give the same example. Let’s say that you are going to a battle. You have three weapons. One is a knife, one is a sword, and the other is either a gun or a rifle. In the middle of the road, you are saying that I don’t want to use this gun. Interest rate tool is something like that. The Central Bank has to use not only its

own tools, but also the tools of the monetary policy and financial policy as well and it should not do a compromise and it should use them all. To me, it looks like the Bank will not use interest rates as a tool. Probably, Fitch has the same outlook as well. Thus, I have some reservations. If the CBT can use it, then there is no problem. Of course, our society has also pushed it to this point. Interest lobby and all of these things as well are in the picture. Economy can’t be managed with slogans. You have to be very open in economy. You have to be flexible. Also the same is true with the financial policies. We are constantly using the taking the rabbit out of a hat model in both policies. For example, we can’t increase the interest rates, so let’s increase the reserve requirements. First it surprises, but then it doesn’t have the same effect. Then we come to the budget. In the budget, we are unable to do the direct and indirect tax reforms. We can’t go against the losses and take the precautions against the unregistered activity What are we doing instead? We are creating 2B, new Reciprocity Law, and now introducing paid military service. These are good things; it saves the budget, but only for that year. What are we going to do next year? We again need a rabbit. We are also able to find that rabbit. Let me also say that they made this concept of taking the rabbit out of the hat, as something continuous in the last 5 years. That is something different, that is also a success, but it cannot continue like this. Taking rabbit out of a hat is fine, it gains us some time, but we have to do these fundamental changes as well. It seems to me that we have been neglecting that.

Q: In retrospect to this, I want to say something about the unregistered economy. In my life, I have seen many governments from the left, from the right, or coalitions. Although all of these were talking about taking measures against the unregistered economy, we are still talking about it. Why cannot achieve it? Is there some structural problem or does it originate from political apprehensions?

Actually, a lot of precautions have been taken. For example, some precautions such as the enforcement of some expenses having to be made through the bank in order to record them etc., along with not being able to pay cash. Yet still being unregistered can be alluring. Some don’t want to be registered. Some can be

left unrecorded. Some are smuggled and haggled. This happens not only in Turkey, also in Italy and other developed countries as well. The place where these things happen less is countries like the United States. It happens there too, but I believe it is around 10% to 15%.

Q: How do you evaluate the fact that the Central Bank has not held any FX selling auction this week concerning the exchange rates? What should be the precautions concerning the rise in the exchange rates?

Just recently, I read in one of the articles of Gazi Erçel. It was an article about an institution in America, which did research concerning all the nations. The Turkish Lira is still seen as 12% more valuable against the US Dollar. Of course, the Central Bank doesn’t give a US Dollar TL exchange rate target, but its one eye

is always there. This is because, when the exchange rates go so high, then our domestic market, prices, and inflations and the Central Bank’s inflation targets are also affected along with the inflation itself. Of course, when you look back, there is only one thing that it does, intervention via FX buying. That is not a solution. I am against it. We are unnecessarily utilizing our reserves. It produces aimed results a day or even half a day. Then its effect fades away. Thus, unless the relationship between the US Dollar and the Euro stabilizes, the intervention is meaningless, the US Dollar is becoming more valuable, and we are again returning to the beginning.

Q: You keep saying that since the crisis is an external one, the precautions taken inside are not so effective.

This is like pouring water into our home while our neighbor’s house is burning down. If that fire jumps to us, it can be a precaution, but if you are able to pour water to your neighbor’s home, then that would be smarter.

Q: Well, what is your expectation on inflation? Do you check the Sariyer Bazaar?

There is inflation in the market, there is an increase compared to last year. However, I am already thinking that inflation will be higher in the upcoming period, as compared to its present level. Anyhow, Ali Babacan also said the same thing, as he stated that the inflation can be 10%. I am also expecting it. My first estimate

was about 7.5% to 8%. Back then, some people found my estimate to be too high. Now we have come to 10% level.

Q: Are we talking about a permanent increase due to an increase in core inflation or it is a temporary increase?

Of course, energy has a great effect. I mean, that is a serious effect caused by imported goods to Turkey and energy is a major part of it. But the worst part is that when we leave energy out of it, then we still see the same rising trend. Before, it wasn’t like this. When we look at 6 months or 1 year earlier, there was not any

significant increase in the core inflation. Sariyer Bazaar is the summary of the subject, but I see it in textile products, as well as in food products. I am filtering the seasonal effects. However, when I look at in general, there is an increase in inflation. This is going to happen, it is inevitable. While the exchange rates have gone up to this level, inflation cannot stop, it will have to increase.

Q: The exchange rates have gone up to these levels, and some are also saying that it can increase even more. So, if we also take the increase in the core inflation into account, aren’t we awaiting a high inflation in 2012?

My expectations are also the same, as it can be like 2011. If there is no great decrease in the current account deficit and even if there is, it doesn’t matter, because decrease in the current account deficit means that demand can decrease. Instead of reduction in production, if there is a decrease in domestic demand,

then the producer may not be able to increase their prices. This will create other problems. This time, the producer will lose money and go bankrupt. Thus, I am expecting a high inflation around 9-10% in 2012.

Q: The result from all of this talk is that the visible problem in Turkey is the current account deficit financing and the quality of its financing. What causes the current account deficit? One of the reasons is the import of intermediary goods. Hence, there might be a structural problem in the

Turkish economy. Unless this structural problem is solved, we will continue to undergo the problem of current account deficit.

Yes, absolutely. What you have just said is a great summary of the situation. Turkey’s main problem is the current account deficit, but the invisible problem underneath it is a structural reform. Not only the current account deficit, but also the taxation is part of structural reforms. Investments in energy are also part of these

structural reforms. Another is the partial import substitution. We have to go from education to justice and to the health system. Some of it has to do with legal reforms, while some of it is about political reforms. Turkey always has disregarded these things. Not only this time, but every time, the same thing happened. When we look back to the last 30-40 years, we always pushed these things back and solved everything by taking out a rabbit out of the hat. These are all temporary solutions. These solutions are good in the beginning, but then we come to such a point that all problems are accumulated. In the past, inflation was exploding during our youth, now the current account deficit is exploding. That is the visible part. What you said is really a great summary. The real part is the structural reforms.

Q: Then, you are not so optimistic about the interest rates?

No, I am not. The interest rates will continue to become higher, especially in a country where inflation is getting higher. Accordingly, it is above the inflation around 1-2 points. Thus, unless we solve the problem of the current account deficit that we have been talking about and if we also have a need for hot money, then interest rates will remain as they are.

Q: As a last question, let me ask this. What are you seeing in 2012 globally and where is Turkey in this picture? What are the special precautions that need to be taken, so that we can overcome it with minimum damage?

I am a bit pessimistic there. I think that this global crisis has three phases. The first phase was the United States of America and that has not been solved yet. It has lightened, but still it is unresolved. America is not the old America. In addition, it has jumped to Europe and I think that Europe’s situation looks worse than

America. I don’t think there will be recovery there in 2012 either. Thus, these two phases will also come in 2012. I also think that in 2012, this crisis will become more effective in countries with emerging markets and in developing countries. The global crisis will show its effects in China, Brazil, India, Turkey, and Mexico.

The US, EU, and emerging economies create the three carrier legs of the global system. The two of these (the US and EU) already have been damaged. If the third leg is also damaged, there won’t be anything to carry the system. I think that the real global crisis will be in 2012 and unfortunately, I also believe that this will have big impact on Turkey. We are losing these opportunities. I hope that instead of throwing Fitch result away, we will take it as a warning and that we will lighten the effects of this crisis. I am pessimistic for 2012. I believe that the fire will grow bigger in 2012.

Q: The current crisis is still manageable...

Exactly, however it will become unmanageable in time. Hence, we will see that the solutions proposed will not solve the problem. Everyone has to solve this with full cooperation with each other. For example, right now Europe and America has to come together and they have to look for precautions to stop this crisis

from effecting China and other emerging economies. Because just like an aftershock, every crisis will turn and hit the one that has caused the original crisis in the first place. Thus, I am pessimistic in this regard.

Kaydol:

Yorumlar (Atom)